Cargoes delayed by the grounding of container ship the Ever Given in the Suez Canal earlier this month are beginning to arrive at ports around the world, leaving workers like haulage driver Harris in Singapore rushing to catch up on the backlog.

As the blockage was removed and Egyptian port workers funnelled hundreds of delayed vessels through one of the world’s busiest waterways, Harris had “not many orders . . . to collect”. But now “we can see more orders coming in”, he said, adding that his company warned staff there would be a jump in work in the weeks after the canal reopened.

Singapore is the most common destination for the container ships that were stuck in the Suez queue — of the nearly 100 delayed box-carrying vessels, about 20 per cent were destined for the Asian hub, according to data from supply chain visibility group project44.

But it is by no means the only port battling with a surge in traffic — and this puts fresh pressure on global supply chains which were already struggling to cope with the problems posed by the coronavirus pandemic.

Keith Svedsen, chief operating officer of APM Terminals, the world’s third largest container terminal operator, said the main impact from the Suez disruption was felt in Europe this week, with “pressure points” at its Spanish and Nordic ports.

Terminals at hub ports in Malaysia, Oman, Morocco and Spain have been running at “emergency mode or at capacity” to deal with large increases in volumes as shipping carriers dumped cargo for forwarding to other ports, he added.

The Port of Antwerp in Belgium expects a rush in activity commencing this week which will persist until June, although it said it could cope without major delays.

Its rival in Rotterdam tells a similar story. “The bottom line is we’re soldiering on,” said Leon Williams of the Rotterdam Port Authority. “Ships would have to wait longer to discharge their cargo but it’s not a crisis.”

PSA, one of Singapore’s two main commercial port terminal operators, said the “first wave” of container vessels from Suez had reached the island’s shores, adding their cargo had been “handled smoothly” thanks to “detailed pre-planning”.

While European and Asian ports have steeled themselves to cope with the congestion, the rise in traffic has created knock-on problems beyond the docks. Trucks and railways that move goods to and from ports have become a bottleneck at ports such as Sweden’s Gothenburg. “The whole system is geared towards a normal week,” Svedsen said.

UK importers said goods which were held up in the Suez queue and were originally due to arrive now would take up to 10 more weeks, partly because of limited slots for trucks at warehouses.

Meanwhile eurozone supplier delivery times are at their longest in 23 years according to the IHS Markit purchasing managers’ index, a widely-watched survey of business activity; as a result, eurozone factory input cost inflation has accelerated to its highest level in a decade.

The extra disturbance for global logistics networks which were already stretched by the pandemic has pushed up costs for exporters and is straining production lines.

Global shipping has been battling with chaotic schedules for months due to swings in consumer demand for goods, as well as factory closures and Covid containment measures which have slowed down ports’ operations. As a result, since last autumn there has been a shortage of empty containers in places where they are needed.

In February, PSA in Singapore said it was “ramping up additional capacity and resources” due to a “surge in vessel calls and container volumes”.

Shipping companies are desperate to return empty containers to Asia from Europe as quickly as possible to avoid any further hold-ups.

Some have resorted to buying new boxes. This month Hapag-Lloyd invested $550m to buy 150,000 20-ft containers. Rolf Habben Jansen, chief executive at the German carrier, said he expected a return to pre-pandemic levels of service by the middle of the third quarter, helped by loosening Covid-19 restrictions in Europe.

“We see some light at the end of the tunnel. We could have done without the Suez incident,” he said. “Boxes will be tight over the coming weeks.”

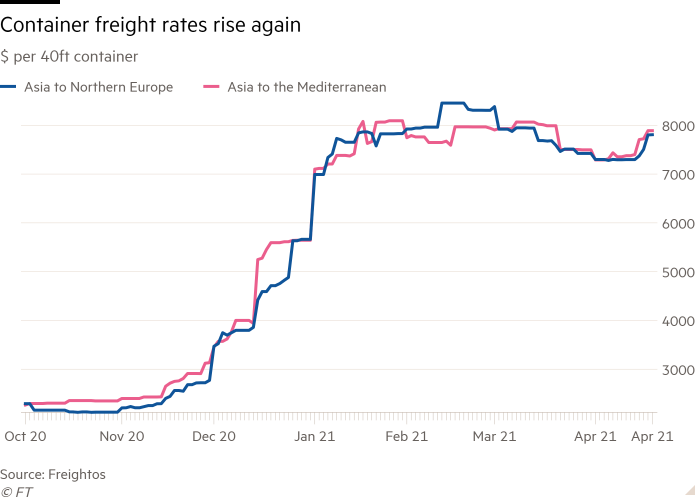

The shortage of containers has pushed up freight rates from Asia to Europe, which peaked in March and had begun to fall until the Suez blockage. The cost of a 40-ft container has since risen by 7 per cent to $7,807, according to booking platform Freightos — 450 per cent higher than a year earlier.

Alan Murphy, chief executive of consultancy Sea-Intelligence, said European exporters faced higher prices as a result of the rush to get containers back to Asia, particularly for low-value commodities and goods such as scrap metal.

“If you’re looking to export anything out of Europe, you’re going to be hard pressed to find containers and space without paying very high freight rates,” he said.

Higher prices are not the only challenge. Pawan Joshi, executive vice-president of product management and strategy at E2open, whose platform handles 26 per cent of the world’s shipping bookings, said component shortages in supply chains threatened knock-on effects.

Citing the example of the computer chip crunch which has recently forced some carmakers to curtail production, he said that earthmoving equipment, generators and air conditioners were among the production lines that face the risk of similar disruption.

“The silent, longer-term disruption comes from making other products,” he said. “If you put that [against] the backdrop of the semiconductor crisis, then we expect to see that — not immediately because there’s inventory [at the moment], but in the coming weeks.”

Additional reporting by Valentina Romei

"port" - Google News

April 26, 2021 at 11:00AM

https://ift.tt/3xr33X5

Global ports grapple with backlog from Suez Canal blockage - Financial Times

"port" - Google News

https://ift.tt/2VXul6u

https://ift.tt/2WmIhpL

No comments:

Post a Comment